Dive In

Impact of the coronavirus pandemic on the global economy

Since the COVID-19 outbreak was first announced, it has spread to over 190 countries. The factor of uncertainty afflicting the economic system and the capacity of decision makers to respond to the shock of the COVID-19 pandemic in a timely and effective manner are significant. Fears of the impact of the coronavirus on the global economy have rocked markets worldwide.

It is clear that the impact of the spread of COVID-19 on the global economy will exceed the financial crisis which hit the world in 2008. It is approaching the Great Global Depression that occurred in 1929 and continued until the 1940s.

Cuts in economic forecasts

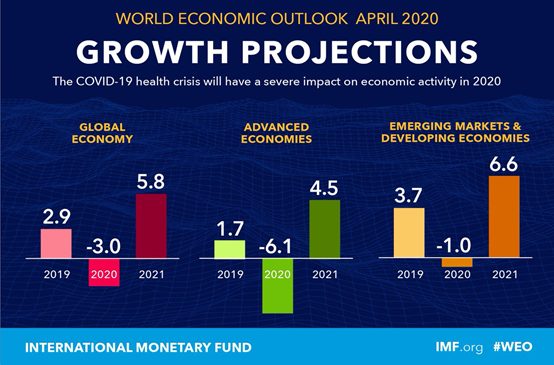

According to the latest update of the International Monetary Fund (IMF), the growth projections for the global economy are expected to shrink this year by 3%, then to rebound next year and to score 5.8% if the virus is contained, which is the best score since 1980.

The IMF estimates $9 trillion in excess of the gross domestic product (GDP) of Germany and Japan combined. It also expects the US economy to contract by 5.9% this year, then to recover and record 4.7% growth in 2021. In contrast, the IMF expects the Chinese economy to grow by 1.2% this year.

High unemployment

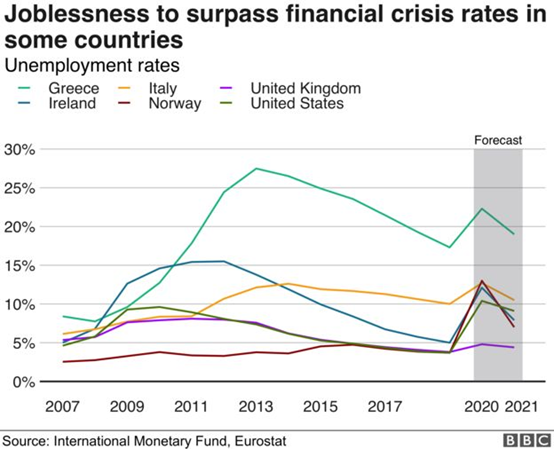

Based on the different scenarios of the impact of the COVID-19 pandemic on global GDP growth, the International Labour Organization (ILO) estimates that global unemployment has increased by between 5.3 million (the “optimistic” scenario) and 24.7 million (the “pessimistic” scenario). For comparison, the 2008-2009 global financial crisis increased unemployment in the world by 22 million people.

Global stocks hit

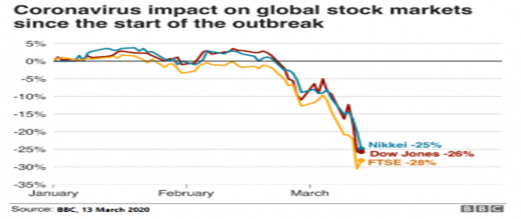

Significant shifts in stock markets, where corporate stocks are bought and sold, can affect many investments, especially in pensions or individual savings accounts.

FTSE, Dow Jones Industrial, and Nikkei indices have witnessed massive declines since the start of the pandemic on December 31. The Dow Jones and FTSE indices recently made their biggest one-day drop since 1987. Some analysts cautioned that markets could fluctuate until the pandemic is contained.

At the banking level

Many experts suggest that the banking sector has learned from the 2008 financial crisis lesson, and it is unlikely that it will be negatively affected by the pandemic, as reserves are higher and the banking system in general is safer. However, there are still concerns about the impact of the shocks and negative expectations, which may push citizens into a state of panic in their dealings with banks. Likewise, the recession may lead some companies to go bankrupt and default on loans and installments to banks. This could cause a real crisis if its impact is expanded.

International trade

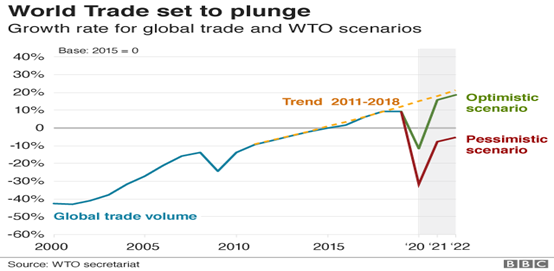

The World Trade Organization (WTO) stated that the drop in

the world trade is growing worse, predicting a severe decline in international

commerce this year compared to the 2008 experience.

The WTO forecasts a contraction of between 13% and 32% this year.

The organization also stated that for the year 2021, a recovery of between 21% and 24% is expected.

The energy sector

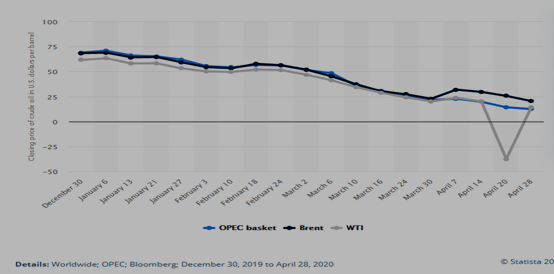

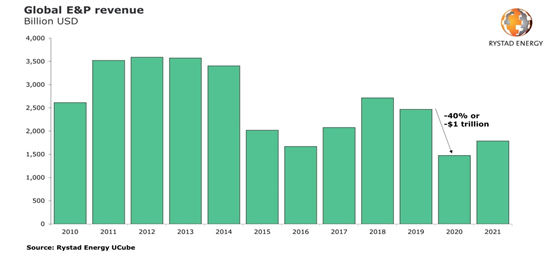

There are expectations of a decline in revenues of international oil and gas companies by one trillion dollars this year, or 40%, compared to 2019, due to lower oil prices and lower demand for crude oil.

The tourism sector

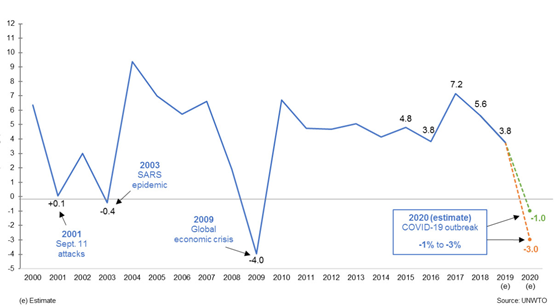

The UN World Tourism Organization (UNWTO) expects that the number of international tourists will decrease by 20 to 30 percent this year compared to 2019, according to the latest assessment of the tourism situation as a result of the spread of the coronavirus and the subsequent restrictions on travel around the world.

The UNWTO also expects this decrease in the number of tourists to translate into a decrease in tourism revenue ranging between 300 and 450 billion dollars, representing a third of the income generated in 2019 of $1.5 trillion.

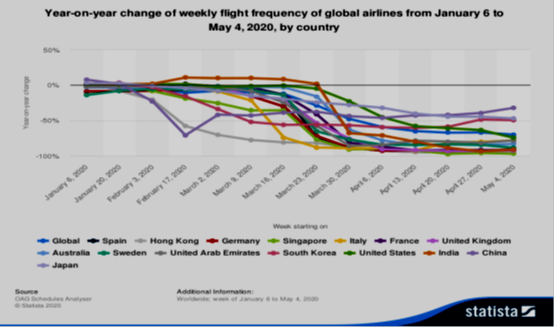

The aviation sector

Alexandre de Juniac, President of the International Air Transport Association (IATA), announced that airline losses will reach about 314 billion dollars this year, down 55% compared to last year due to the continuing crisis of the coronavirus.

Despite the clear danger that the global economy is in, there are also reasons to be hopeful that these worst-case scenarios can be avoided. Governments have learned from previous crises that the effects of a demand-driven recession can be countered with government spending. Consequently, many governments are increasing their provision of monetary welfare to citizens and ensuring businesses have access to the funds needed to keep their staff employed throughout the pandemic. In addition, the specific nature of this crisis means that some sectors may benefit, such as e-commerce, food retail, and the healthcare industry, providing at least some economic growth to offset the damage. Finally, there is a fact that the crisis may have a clear end date when all restrictions on movement can be lifted (for example, when a vaccine is developed). Taken together, this means it is at least possible that the global economy could experience a sharp rebound once the pandemic is over.